We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

Blog

Welcome to the C-Line Blog! Our extensive line of over 500 products are designed to help you be more productive whether you’re at school, at home or in the office. We love to explore new ways to use our products and encourage you to comment on how you use them too. Look for updates on new products, and discover creative uses for items you may not have considered. We’re delighted to invite you to be a part of the C-Line community! Read on!

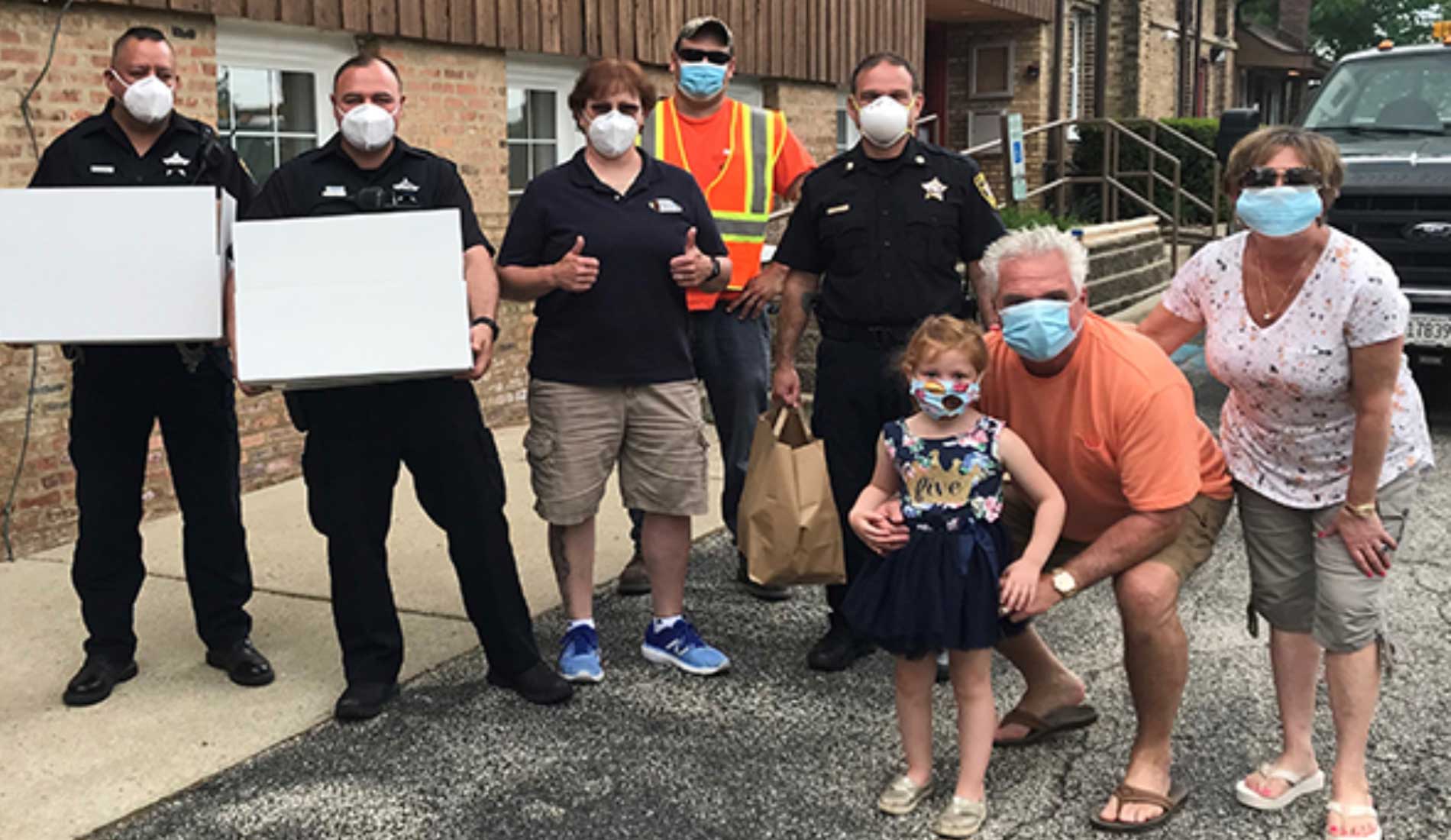

Giving Back

As a newer employee at C-Line Products, I knew the company was family-oriented in their approach to everything. I was not surprised, when, in April, C-Line donated 100 N95 respirator masks to support essential workers of the village of Mt. Prospect’s COVID-19 response efforts.

Wine By Your Side® – Perfect When Working from Home

If you are like me, you may still be working from home. And like my company, yours may have implemented a virtual happy hour, so employees can get to know each other on a more personal level. It’s perfect, no one has to drive, people get to pick their drink of choice, and everyone has a good time. All while getting to know their coworkers. Even if your company doesn’t host a virtual happy hour, maybe you attend virtual cocktail parties with friends or family to stay in touch.

Wine By Your Side – Perfect Anytime, Anywhere

Do you enjoy going out to dinner and having a glass of wine? Maybe you even like going to a BYOB (bring your own bottle) restaurant so you can bring your favorite wine along. Or have you ever gone to a restaurant known for wine? Did you notice that once everyone ordered a bottle of their favorite wine, everything else, plates, silverware, water gobbles, seemed to be adrift in a sea of wine bottles, leaving hardly any room for appetizers, bread, and plated entrees? Wine bottles take up a lot of room on a table.

13 Uses for C-Line’s Storage Box at Home

Got a hobby? Great. This is where a C-Line’s Storage Box comes in handy.

13 Tips to Creating a Professional Portfolio

by Frank Moriarty

Frank Moriarty has worked for several international consulting companies including RSM McGladrey and FIS International. He is a professional presenter and has helped many executives during their job transitions with his 'Building a Professional Portfolio' session.

Checking My List Twice: Creating a Christmas Card List and Folder

Okay, it’s time to fess up!

How many of you stopped sending Christmas cards years ago? You don’t know why. Perhaps

you just got too many “return to sender, address unknown” cards back in the

mail.

How to Better Organize Your Office with C-Line’s Self-Adhesive Labeling Pockets

Do you search on Pinterest for organized office spaces for inspiration? Do you wish your office space was just as organized and pretty? Today, I will show you how to create labels and to better help you get your office Pinterest ready.

Before and After: Self-Laminating Magnetic Style Name Badge Kit

This past weekend I was at a friend of mine’s house. When I walked in the door she was writing a list of chores each person in the house had to complete that week.

Wine By Your Side® – Perfect Gift for Any Occasion

Valentine’s day is around the corner. Are you stumped about what to gift your significant other? Or how you would like to treat yourself on that special day? C-Line can help relieve some of your stress.

Tip of the Month: Keep Events Sorted with the Expanding File with Hanging Tabs

January seemed to disappear in the blink of an eye, which is another reason for all of us to get organized. Recently a customer, who is an event planner, reached out to mention that she has a lot of events and fundraisers happening throughout the whole year and a notebook is simply not enough to keep her projects organized.